Written by Chris Garrard, Cadence Capital Limited

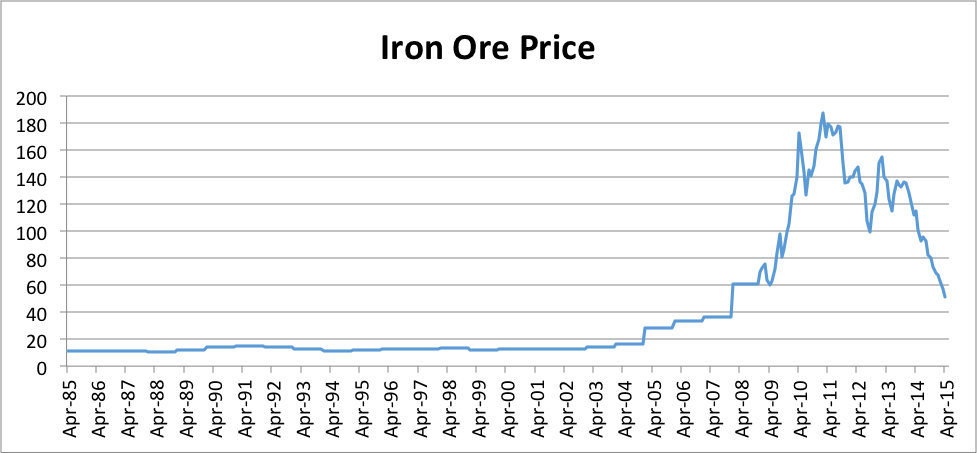

As can be seen from the below chart the iron ore price has had an amazing rise and fall. The price of iron ore was below $20 a tonne until 2005. It peaked at around $190 a tonne in early 2011, and has since fallen to about $60 a tonne.

Source: indexmundi.com

This pattern often repeats itself in commodity cycles. Increased demand initially causes the price of a commodity to increase. Mining then becomes extremely profitable, which encourages many more mines to be constructed. The new mines then come online a few years after the commodity price has risen, and the market becomes oversupplied. This then causes the commodity price to fall until the highest cost producers cannot make money and stop producing.

In this particular iron ore cycle we have seen a small drop in iron ore production by some mining companies as the iron ore price has fallen, but we believe the iron ore price needs to fall further from here to cause a meaningful decrease in iron ore supply.

As an example, Atlas Iron is one of the highest cost iron ore producers in Australia, primarily due to its use of trucks to transport iron ore instead of trains. Atlas recently announced that it would cease iron ore production, only to later announce that it would continue producing after renegotiating costs with suppliers. These cost reductions have the effect of keeping the iron ore market oversupplied for longer.

We also expect that small decreases in iron ore production by high cost mines will be more than offset by new production from mines that began construction between 2010 and 2012 while the iron ore price was high. An example of this is the Roy Hill mine in Western Australia. Construction of the mine began in mid 2011 and the mine is expected to begin producing iron ore in September this year.

I will now discuss Fortescue in detail. FMG mines iron ore in the Pilbara region of Western Australia. The iron ore is transported to port by train, and is primarily shipped to China.

[pullquote cite=”Chris Garrard, Cadence Capital” type=”right”]Fortescue has the highest cash costs and the lowest grade of iron ore.[/pullquote]

The world’s four biggest iron ore producers are BHP Billiton, Rio Tinto, Vale SA and Fortescue. Of these Fortescue has the highest cash costs and the lowest grade of iron ore. Fortescue is forecasting a significant reduction in cash costs in 2016, but we believe it will still be the highest cost producer of the four big miners.

At Cadence we first shorted FMG at $3.84 in September 2014, and have added to the short position a number of times as the FMG share price has fallen. The current FMG share price is approximately $2.40.

Fortescue currently has a market capitalisation of AUD 7.4b, cash on hand of AUD 2.6b, and AUD 12b in debt. They recently refinanced their debt and there are no debt repayments due until 2019.

In the first half of financial year 2015 FMG made USD 331 million in profit based on 80.3 million tonnes of iron ore shipped. This equates to just over USD 4 per tonne of profit after tax (or USD 5.5 per tonne in pre tax profit). During this period the average Platts 62% iron ore price was USD 82.

The current Platts 62% iron ore price is USD 62. If FMG were unable to reduce costs then they would currently be making a pre tax loss of around USD 14.5 per tonne of iron ore.

In response to the declining iron ore price FMG has focused on cost reduction and recently released guidance for 2016 that they would break even* at a Platts 62% price of USD 39. This converts to an NPAT break even Platts 62% price of USD 45.5 per tonne.

To go from a break even price of USD 76.5 in the first half of this financial year to a break even price of USD 45.5 in 2016 would be an amazing cost reduction achievement.

While it is extremely important for FMG to reduce costs it is only beneficial if other iron ore miners cannot reduce costs in the same way. If they can then the iron ore price will need to fall lower before the oversupply problem is fixed.

[pullquote cite=”Chris Garrard, Cadence Capital” type=”left”]We expect significant mine closures at iron ore between $30 and $40 per tonne[/pullquote]

At Cadence we believe that the strong downtrend in iron ore will continue until we see significant mine closures, which we expect will occur at an iron ore price between $30 and $40 per tonne.

Based on the above analysis we expect FMG will make a loss in the short to medium term, and we are comfortable with our short position in the stock.

*FMG break even calculation includes sustaining capital expenditure of USD 2 per tonne and does not include depreciation and amortisation of USD 8.5 per tonne.