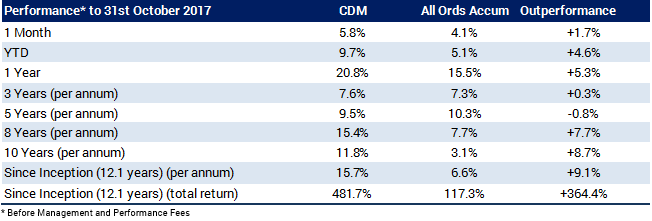

For the month of October 2017 Cadence Capital Limited returned a positive gross performance of 5.8% compared to an increase in the All Ordinaries Accumulation Index of 4.1%. For the past 12 months, Cadence Capital Limited returned a positive gross performance of 20.8% outperforming the All Ordinaries Accumulation Index by 5.3%. As at the 31 October 2017 the fund was 1% borrowed (101% invested).

On the 1st November 2017 Cadence Capital Limited announced that it had successfully completed its Share Purchase Plan (SPP) and Placement which raised a combined total of $50.0 million. All eligible shareholders who applied for the SPP received their full allocation of shares. The SPP and placement received strong participation with over 2,000 existing and new shareholders subscribing for shares at a price of $1.259.

We would like to thank our existing shareholders, brokers and advisors for their continued support and welcome new shareholders to our fund. The Company continues to invest using Cadence Capital’s disciplined investment process and is finding new investment opportunities to add to the existing portfolio.

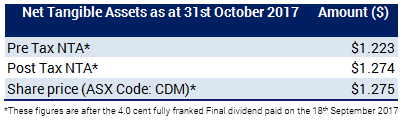

Fund NTA

Fund Performance

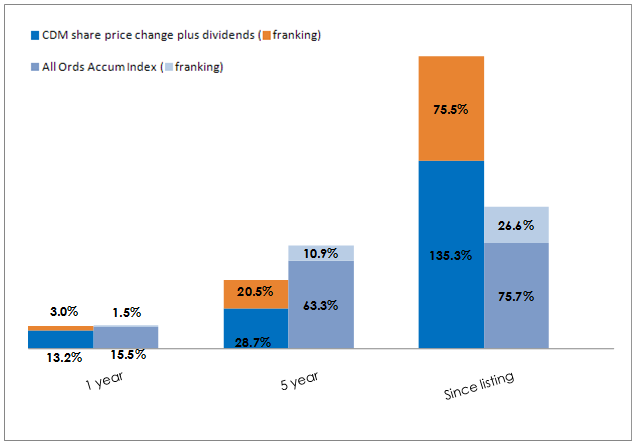

CDM Share Price and Option Returns plus Dividends & Franking

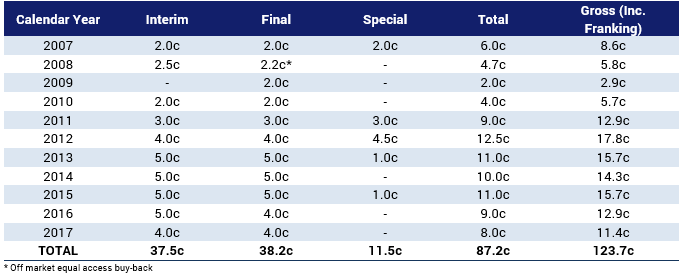

Fully Franked Dividends Declared Since Listing

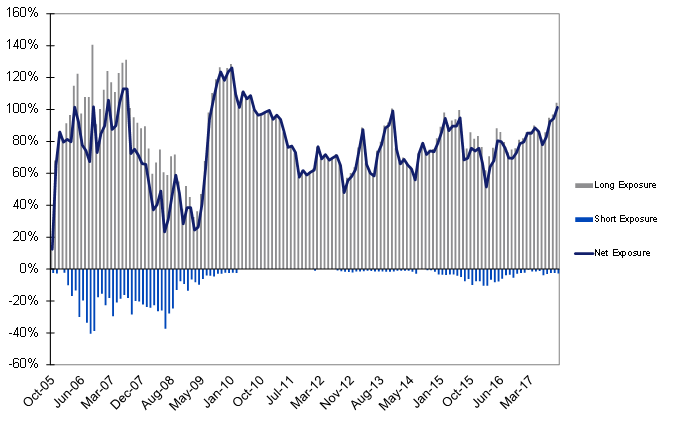

Historic Portfolio Exposure

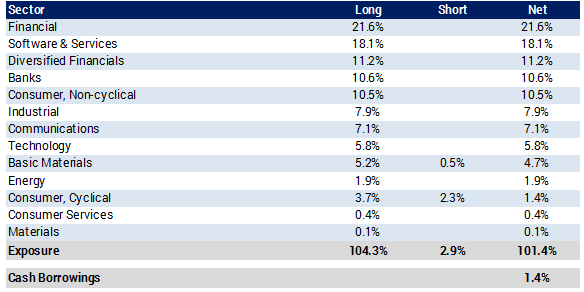

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Cadence Capital Limited is holding its AGM and Investor Briefing at the Museum of Sydney, Warrane Theatre, Corner of Bridge and Phillip Streets, Sydney, NSW 2000 at 2:00pm (AEDT) on Tuesday 21st November 2017. If you would like to dial into the AGM remotely, please click here to register.

Karl Siegling has been quoted in a series of AFR articles throughout October: ‘5 retail stocks that fund managers love’, ‘Macquarie Groups Moore confident on acquisition war chest’ and ‘Late rally propels ASX to another session of gains’.

Karl Siegling was interviewed by Tom Piotrowski for the Commsec Executive Series on recent fund performance and the Company’s Share Purchase Plan.

The Australian Investors Association recently published an article from the Cadence Investing Series ‘The emotion factor in buying and selling.’

We have recently revamped the 52 books you should read before buying your next stock page on our website.