For the month of March 2017 Cadence Capital Limited returned a positive gross performance of 1.6% compared to an increase in the All Ordinaries Accumulation Index of 3.2%. For the financial year to date, Cadence Capital Limited has returned a positive gross performance of 12.2% compared to an increase in the All Ordinaries Accumulation Index of 14.9%.

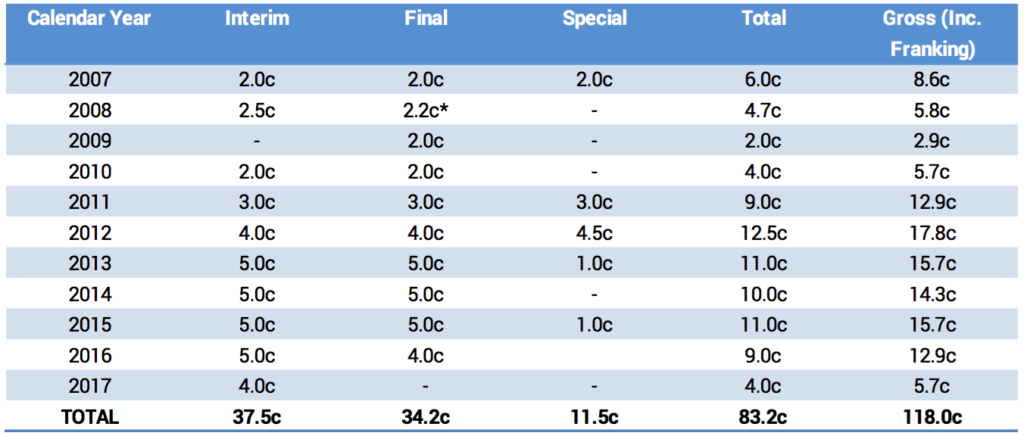

In February 2017 the Company announced a 4.0 cent fully-franked interim dividend. This equates to a 6.7% annual fully franked yield, or a 9.6% gross yield (grossed up for franking credits) based on the CDM share price at the time of the announcement. The Ex-Date for the dividend was the 12th April 2017 and the payment date is the 28th April 2017. Shareholders can participate in the Dividend Re-Investment Plan (“DRP”) at a 3% discount. The DRP Record Date is the 19th April 2017. If you would like to participate in the DRP please complete the DRP Application Form and return it to our Share Registry, BoardRoom Pty Limited. (BoardRoom’s address is on the form).

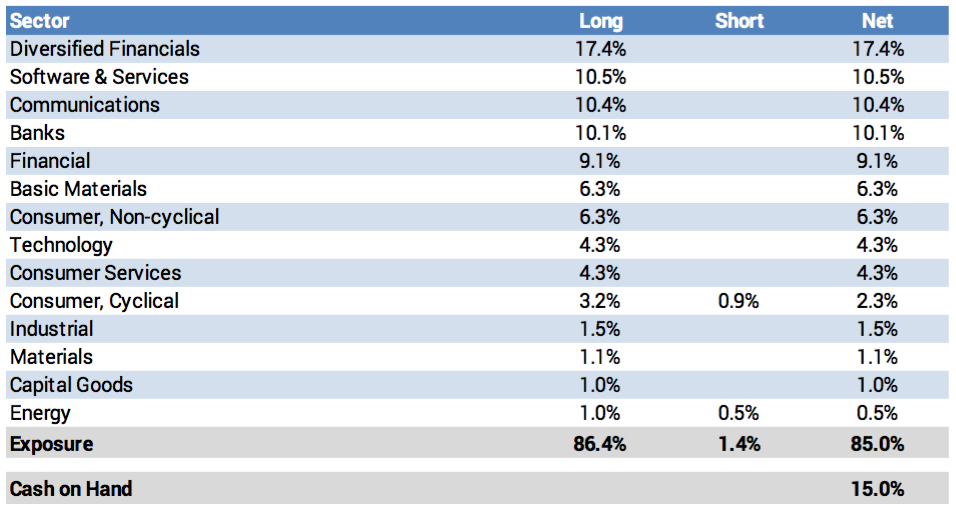

As at the 31st March 2017 the fund was holding 15% cash (85% invested).

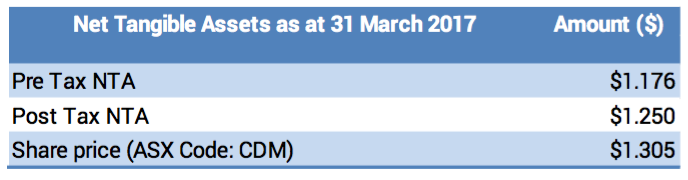

Fund NTA

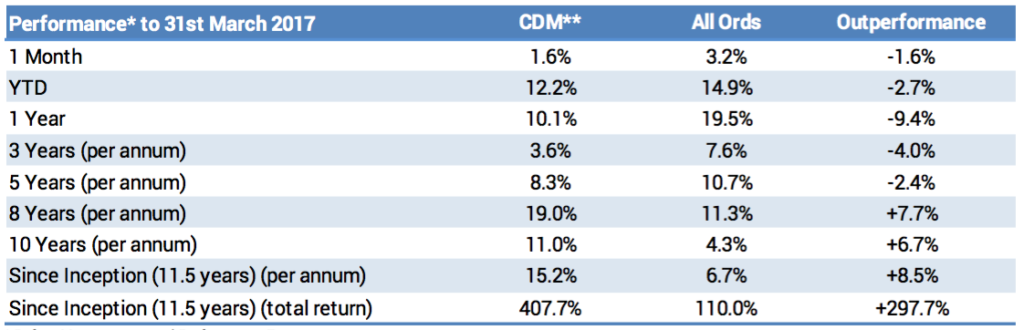

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

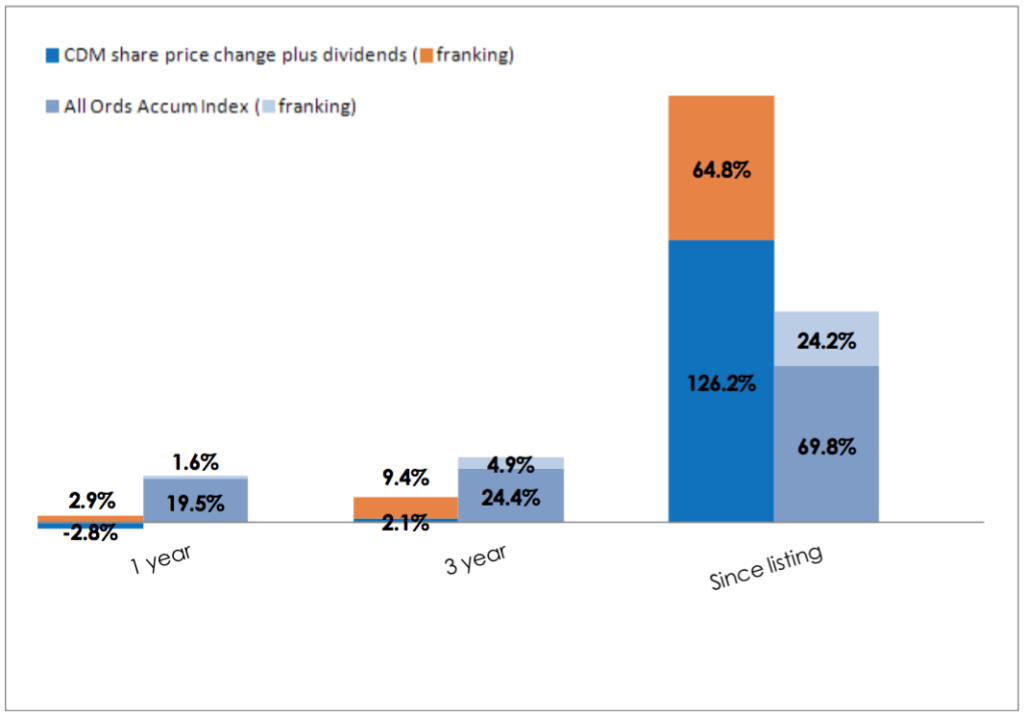

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

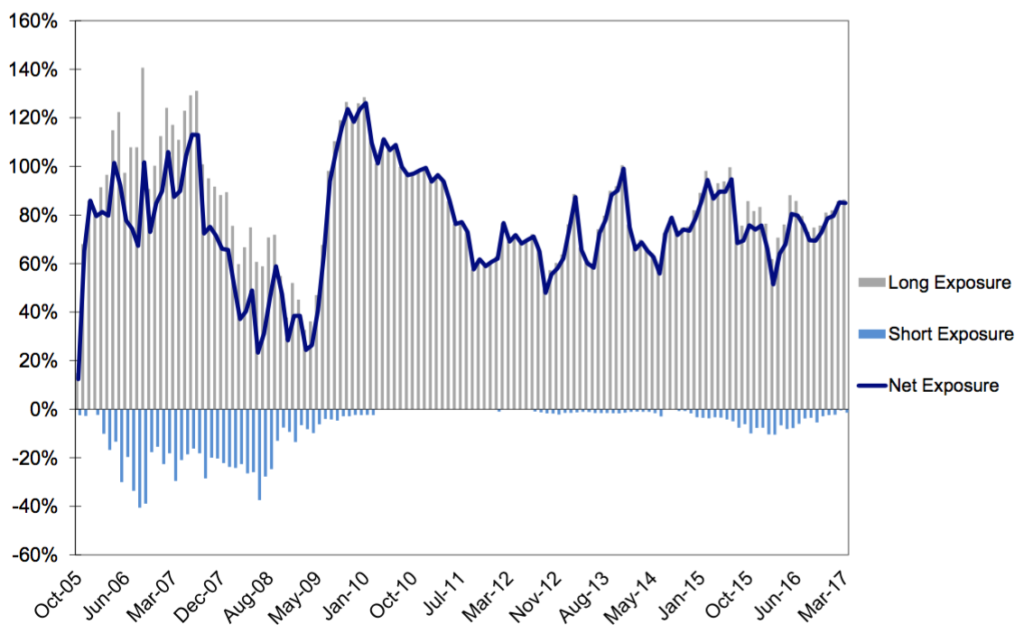

Historic Portfolio Exposure

Portfolio Sector Analysis

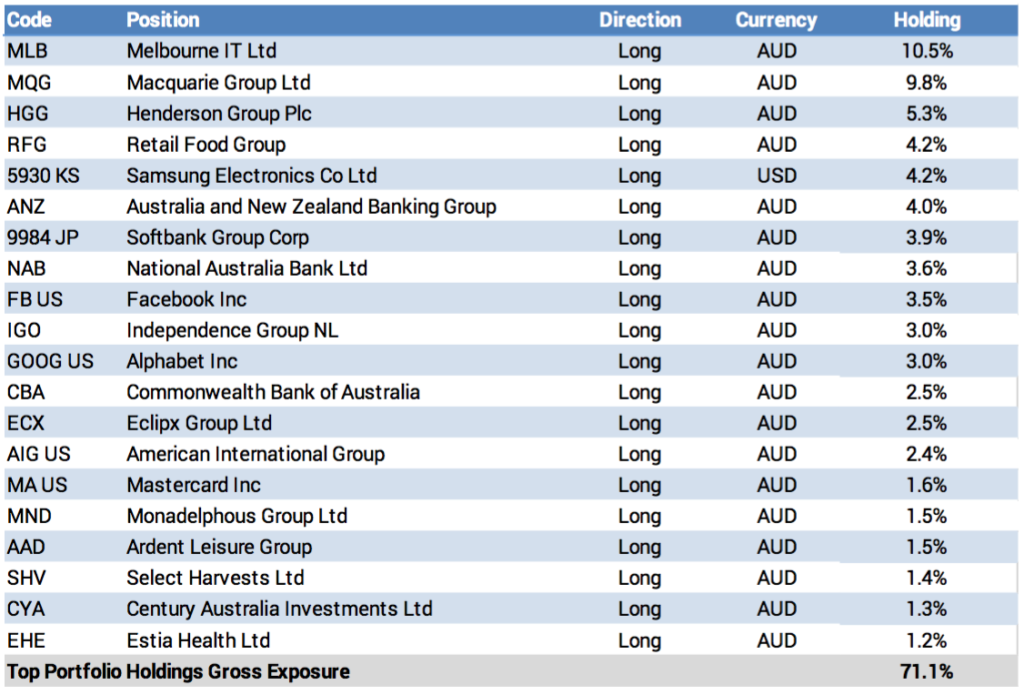

Top Portfolio Positions

Recent News Articles

Cadence Capital recently released its latest eBook titled ‘Has the next resources boom started?’. With insights regarding recent gains in the resource sector, and featuring two ‘live’ examples of current resource investments, we would encourage you to download a copy of the eBook.

Livewire Markets interviewed Karl Siegling as part of their Beyond the Jargon series. Click here to view Karl’s thoughts on Averaging Down.

Karl Siegling was invited to present at the Spring Financial Group Leadership Series. Click here to view a webcast of his presentation titled ‘The top two investment trends in 2017.”

Please visit our 52 books you should read before buying your next stock section on the Cadence website to view some recently added titles.

To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.