Cadence Capital Investment Philosophy

We believe that a combination of both Fundamental and Technical analysis, along with a disciplined stock entry/exit strategy, are key to producing above market investment returns over time. Watch this introductory video for an overview of our process.

Our philosophy is underpinned by four long held investment beliefs:

1. Using both Fundamental and Technical Research is critical

We believe a combination of Fundamental and Technical research has a greater probability of producing higher returns than either Fundamental or Technical research alone.

2. Disciplined ‘Entry and Exit’ strategy

We see the ‘Entry and Exit’ strategy (Technical) to be as important as the investment decision (Fundamental).

3. Open Mandate

Cadence considers having an ‘open mandate’ (which allows the company to invest in any listed equity and have the ability to allocate between equities and cash), as a key tenant in our approach to managing money

4. Long and Short

Having the ability to take both long and short positions assists in generating excess returns.

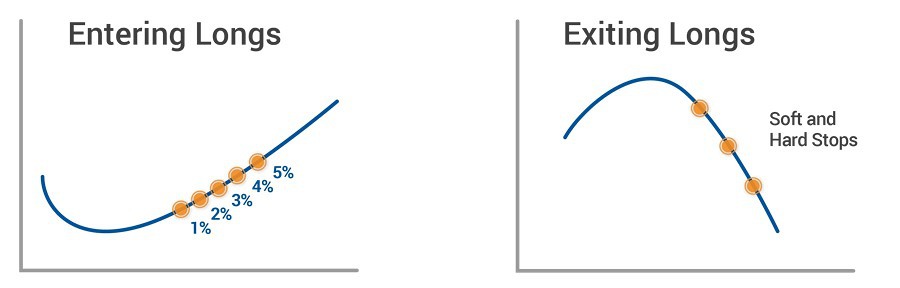

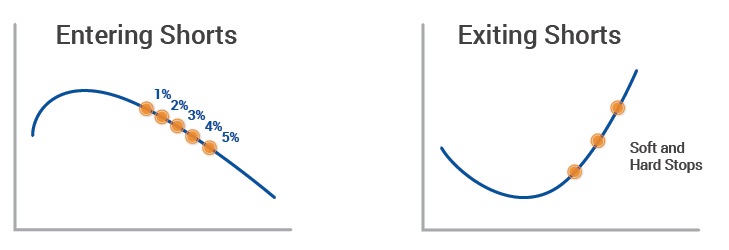

Our process of scaling into and out of positions is highly disciplined

Fundamental Research

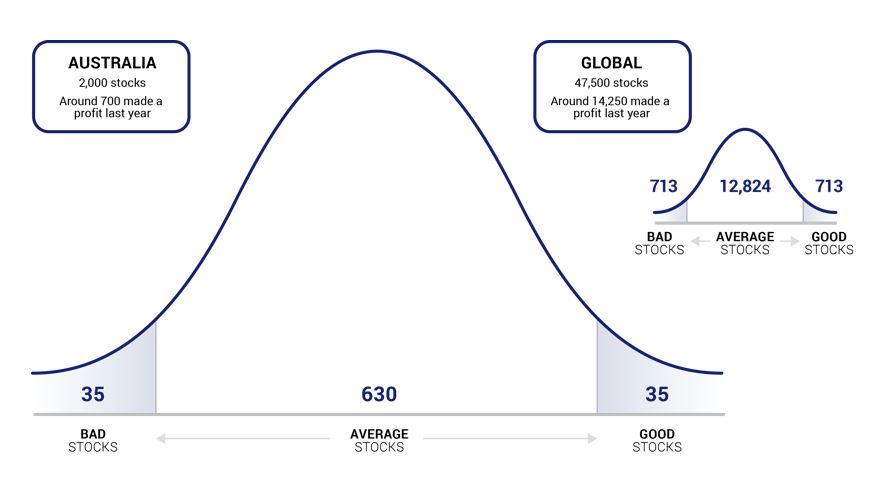

We visit and analyse 600-800 companies per annum to determine whether they are cheap or expensive, as illustrated below.

Technical Research

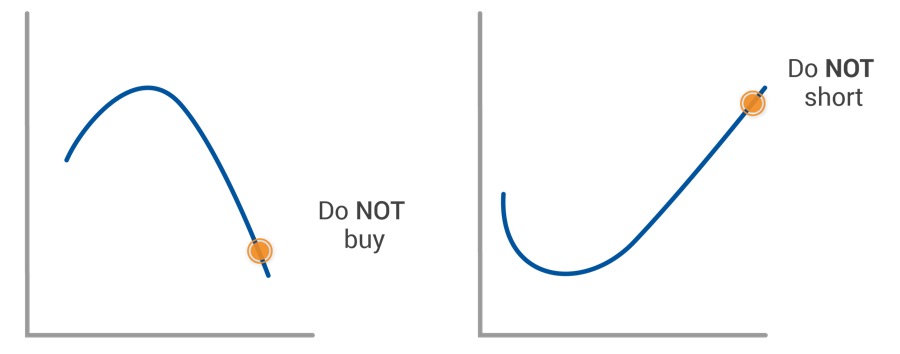

We overlay our fundamental analysis with technical analysis to see how the stock is trending before making any investment decision.

1st Rule: Do NOT buy a falling stock

2nd Rule: Do NOT short a rising stock

3rd Rule: Wait until the trend emerges then scale into and out of positions. DO NOT AVERAGE DOWN

4th Rule: Monitor short positions very closely as markets fall 3 times as quickly as they rise

The Company’s Open Mandate allows us to invest in any listed equity and to allocate between cash and equities depending on how individual stocks in our portfolio are performing.

Many fund managers are restricted on the shares they can invest in; as well as the levels of cash they can hold.

All potential and current portfolio positions are managed and monitored within the Company’s proprietary Cadence Dashboard.

We see this Open Mandate as our edge

10 Books To Read Before Buying Your Next Stock

Funds management involves a lot of synthesis of information and reading. Over the years we all end up reading many investment books and refer to them from time to time.

The team at Cadence has compiled a list of books that have influenced our investment style, or helped provide insight into the investment process.

Whilst not an exhaustive list, the 10 titles contained in this eBook provide a good starting point for any interested investor.